Getting A Handle On The Healthcare Marketing Metrics That Matter

We recently had the opportunity to present to – and field some really thoughtful questions from – students in a couple of entrepreneurship classes at Purdue’s Krannert School of Management. One of the questions was, “How do you know your marketing is working?” Frankly, as marketing services professionals, we often hear this question. There is a perception that marketing is difficult to quantify … and that’s probably true, if the starting point for a campaign is something other than solid agreement regarding the objectives of the effort. After all, why spend Nickel One on any sort of marketing if you’re not expecting real results?

The Unusual Economics Of Healthcare

Of all the categories of marketing, though, healthcare is a sector in which the fundamental economics of the business present some challenges in setting and evaluating marketing metrics. In the US, healthcare provider economics are unlike those underpinning any other consumer or B2B category. For instance, oversupply actually can lead to increased demand. In multiple markets in the US Midwest, for example, intense competition between health systems leads to building binges that actually spur incremental utilization. Another interesting element: the end users of the service have very little to say about the price they pay for the value received. Further, provider profit margins and service incentives are impacted by dozens of variables, including the dynamics of government regulation and the metrics of Medicare. To say nothing of the influence of a procedure-driven compensation model that’s at odds with shifting theories of insurance coverage. It’s no wonder the “how do you measure the effectiveness of marketing” question is particularly thorny in the healthcare sector. The underlying economics are, themselves, particularly thorny!

MKR has worked in this space for nearly 50 years, serving as agency of record for numerous health care networks and systems, as well as members of the healthcare value chain (insurance companies, device manufacturers, blood centers, clinics, physicians groups and associations). While each client and each client objective is different, we have observed some common patterns in developing and assessing “metrics that matter” in healthcare marketing.

Healthcare Network Income Dynamics

A good place to start in understanding healthcare marketing metrics that matter is to understand how money works in health networks. To put it simply, at the system or network provider level, procedures rule the day. We’ve heard it said that “the most expensive piece of equipment in a hospital is a provider’s pen;” this is pretty accurate, with fee-for-service the dominant revenue model, and with numerous incentives (clinical as well as economic) to prescribe, refer and deliver procedures. On one end of the income debate spectrum, payors (i.e. private insurance companies and Medicare) are shifting their payment policies to favor positive patient outcomes, vs. procedures. At the other end of the spectrum, physician compensation and benefits are tied to production (procedure) volume … resulting in some tension.

Dampening Rods In Controlling Costs

There is increasing focus on evaluation of outcomes, and ongoing assessment of quality of care; much of this actually is being advanced by Medicare, which, for over 40 years, has been working to help evolve compensation methods to align reimbursement, or payment with positive patient outcomes – vs. relying solely on procedure volume. Payors increasingly want to adopt value-based contracting, i.e. “How well is a particular patient population (patient cohort or insured group) being cared for; how well are they making progress towards health, and what is the appropriate compensation structure to enable and reward that progress?” Utilization rates in defined enrollment groups provide some of the metrics that factor in this analysis; so do analyses of outcomes.

The general – and necessarily simplified – thought is that if a system is consistently producing objectively higher-quality outcomes across its patient base, it will enjoy increased market share and therefore be able to keep its proceduralists busier. From a consumer perspective, this should be encouraging, because the incentives in the economics of healthcare are being realigned to focus on doing what’s best for the patient – not what will produce the highest volume of procedures.

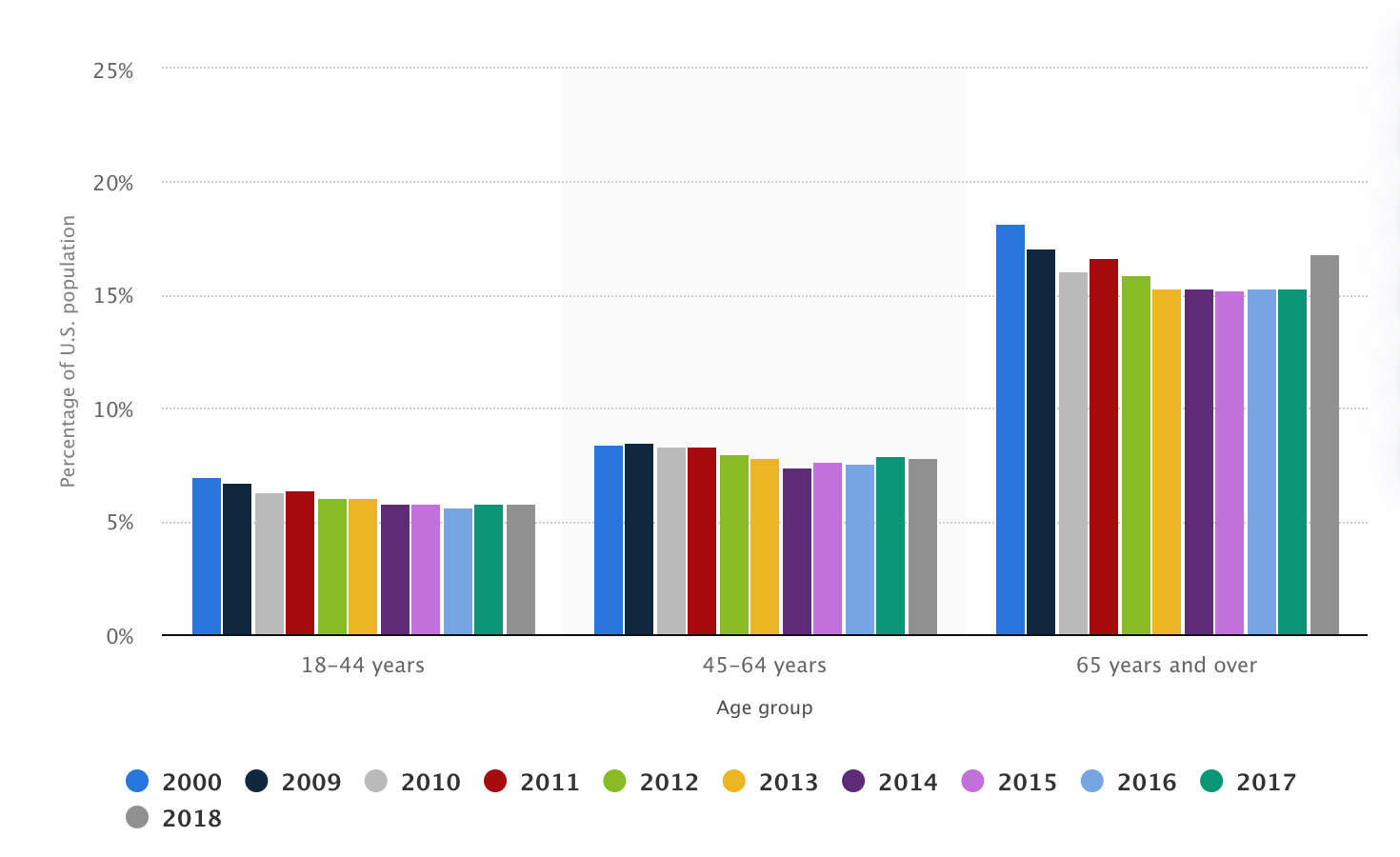

Medicare is a driving force in this process, as the majority of hospitalizations occur among populations aged 65 years and older. Medicare executives continue to push for increased quality of care, decreased hospital admissions and decreased length of hospital stay; for instance, if a patient is readmitted for the same condition within 30 days of discharge, Medicare will likely not reimburse the provider.

Hospitalizations by age, 2000-2018

Source: Statista, 2021

Healthcare System “Cash Cows”

It’s no surprise that the service lines that generate the highest volume of procedures tend to be the ones that correlate to chronic illness and conditions prevalent in geriatric populations. Generally orthopedics, cancer care, cardiac care and womens’ services are seen as the procedure-based “cash cows” in network or system planning; these specialties produce revenue sufficient to sustain marketing dialog with their influencers, choosers, payors and end users. And used thoughtfully in the system’s promotional arsenal, they carry weight in helping providers differentiate on the basis of proprietary brand attributes.

Consumer marketing messages around these services tend to focus on quality of care, reinforcing perceptions of positive patient outcomes, and feeding the “virtuous cycle” of increased focus on quality, increased consumer/payor preference and increased volume … of procedures.

Think About These Metrics

In this environment, then, “feet through the door” attributable to a marketing campaign is generally accepted to be a critically important and highly useful metric. Each system is different in its ability to track and measure this basic measure, but it’s a useful starting point.

There is obvious urgent need to plan ahead to gain agreement from all stakeholders with regard to what you plan to measure and evaluate – and to ensure variable sources of important marketing information such as EMR, patient data warehousing and marketing platform analysis tools aren’t siloed or otherwise unavailable to support evaluation of marketing effectiveness. Waiting until after a campaign is running to try to build the evaluation process is extremely difficult and frustrating.

Pulling It All Together

Healthcare marketers also do well to track the average cost of patient acquisition, comparing it with the previous average cost of patient acquisition to determine the effectiveness of the current campaign. This requires a set of keys to patient financial data, which of course is sensitive; obviously de-identifying patient data is critical, as is a level of data security in accessing and analyzing such information. But every system has this data, and marketers working to advance the cause need reasonable access to it.

For online marketing campaigns, there are numerous metrics that help define effectiveness; these include raw number of website visits, form completion, if applicable, cost per click, cost per conversion (another topic on which planning ahead pays ALL the dividends), cost per engagement, checklist downloads, health risk assessment attempts and completions, position on Google search for tertiary services (i.e. cosmetic surgery) in and around where the hospital is located. Probably if you’re working in healthcare marketing, these and other readily accessible digitally based metrics are part of your assessment routine; key is to avoid focus on “vanity metrics” (i.e. bounce rate, time on page, unique users, pages per session, etc.) that frankly degrade credibility and cloud the picture.

Strategic outcome metrics that tend to be important to healthcare organization executive leadership include system or service line awareness, market share, patient or physician preference, image ratings, patient volume by service line, enrollment, re-enrollment, number of referrals and number of active referral sources, among others – and all compared to available competitive norms.

And, Yes, MKR Can Help

In our decades of providing marketing support across the healthcare industry, MKR has seen it, been there, done that … and we’re willing and able helpers in sorting through the thicket of making meaning out of data. As well as making our healthcare clients more well-known, preferred and remembered for reasons that not only differentiate them, but that help create environments that both more readily advance patient care and help improve healthcare’s bottom line.

Some of this can be challenging to analyze, design and implement. Please get in touch for a no-obligation review of your situation.